OnPay

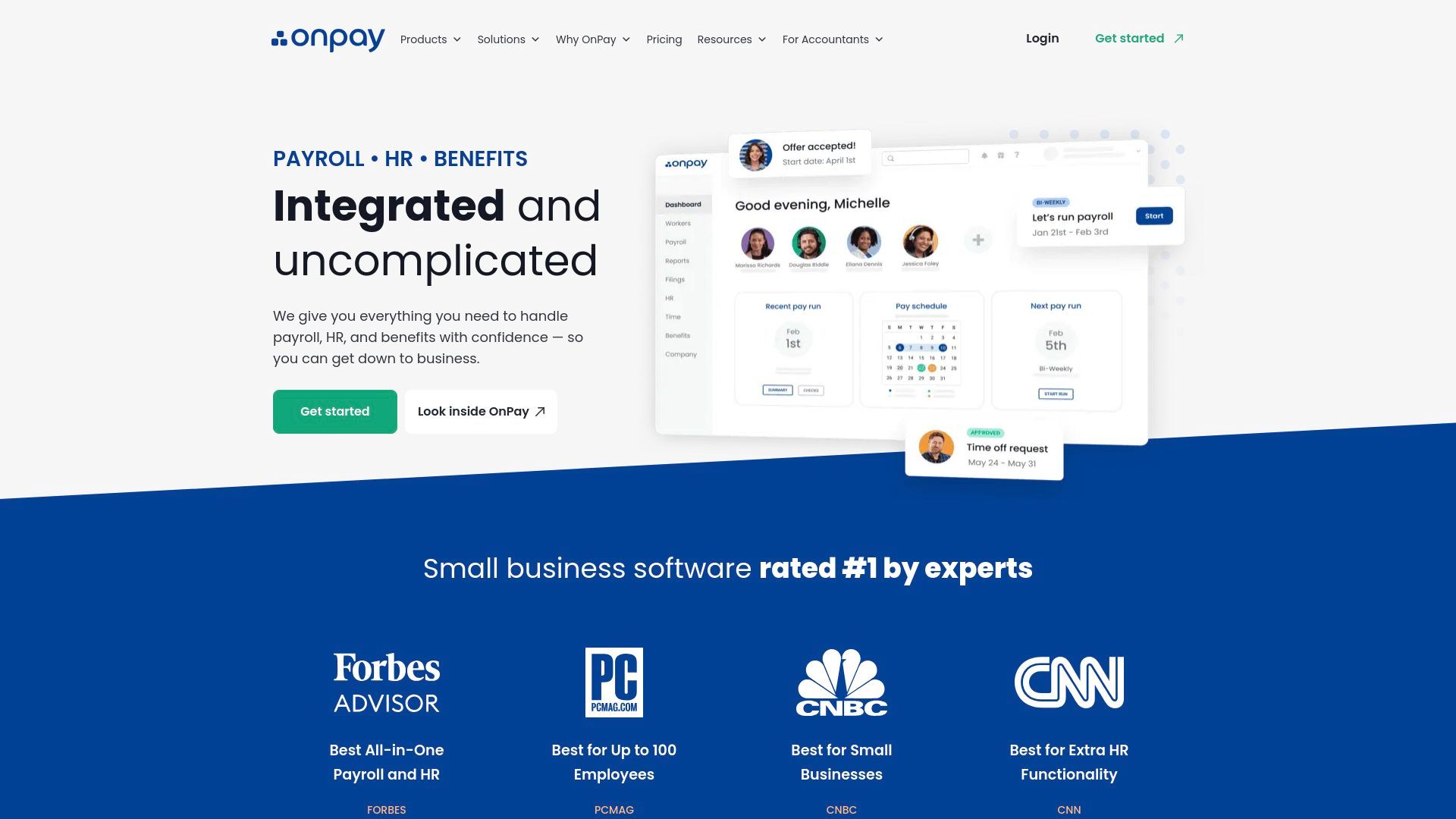

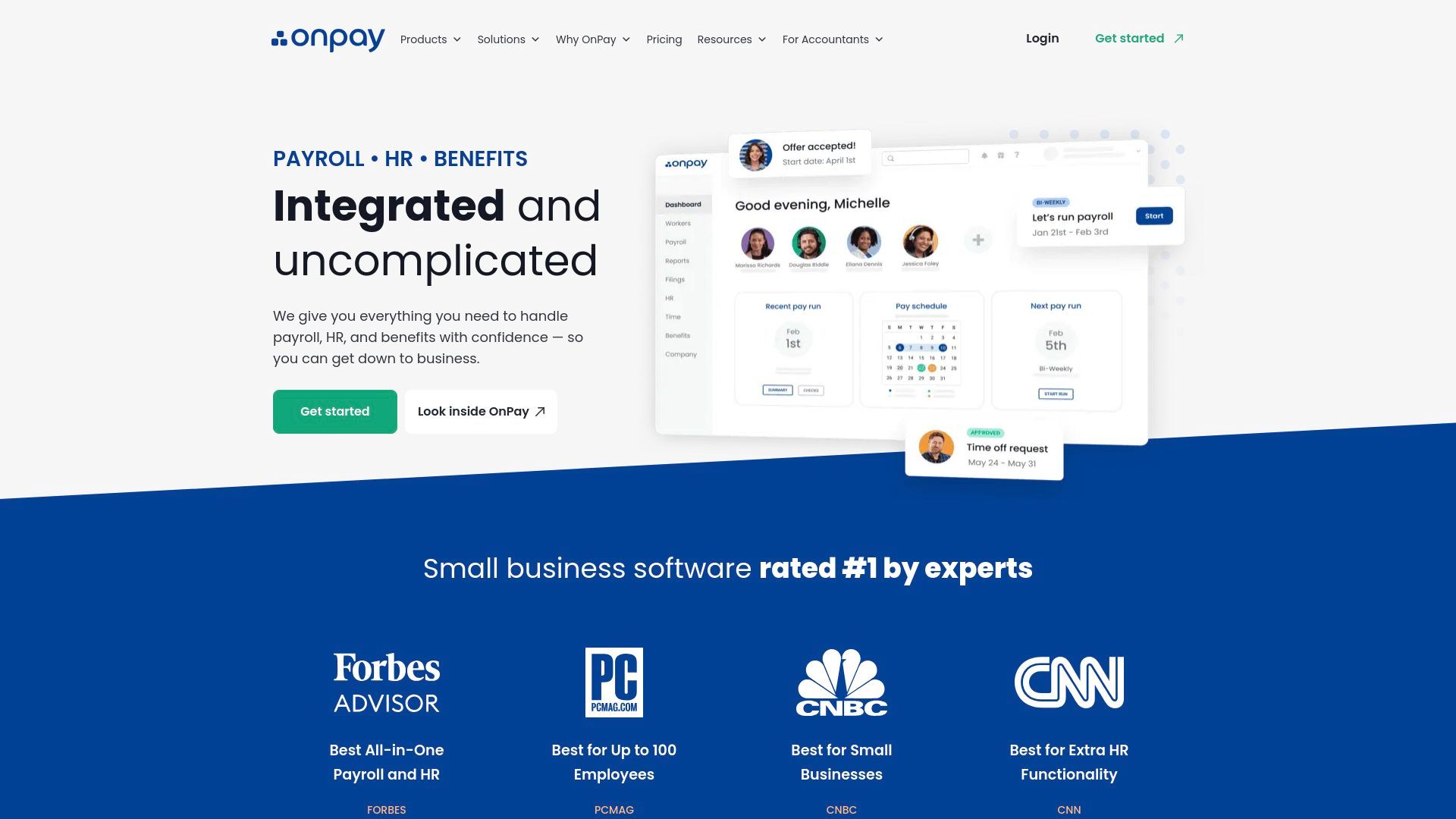

Straightforward payroll service with single-tier pricing that includes all features ($40 base plus $6 per person monthly). Handles tax filings, benefits administration, and HR tools for both W-2 and 1099 workers. Offers unlimited payroll runs but lacks a dedicated mobile app.

OnPay

Straightforward payroll service with single-tier pricing that includes all features ($40 base plus $6 per person monthly). Handles tax filings, benefits administration, and HR tools for both W-2 and 1099 workers. Offers unlimited payroll runs but lacks a dedicated mobile app.

OnPay

Straightforward payroll service with single-tier pricing that includes all features ($40 base plus $6 per person monthly). Handles tax filings, benefits administration, and HR tools for both W-2 and 1099 workers. Offers unlimited payroll runs but lacks a dedicated mobile app.

Category:

Last Updated: Dec 15, 2024

Paid

Starting Price: $46

Learning Curve: Low

Rating: 8.4

Overview of OnPay Features and Limitations

OnPay provides comprehensive payroll and HR services with a transparent, single-tier pricing model. The platform particularly excels in serving specialized industries like farms, restaurants, and nonprofits with specific compliance requirements and tax considerations.

Key Benefits:

Inclusive Pricing: All features available at one price point with no hidden fees or upsells

Industry Specialization: Built-in support for agricultural, nonprofit, and restaurant payroll taxes

Benefits Integration: Manages health insurance, 401(k), and workers' comp with automated deductions

Compliance Support: Handles tax filings across all 50 states with accuracy guarantee

Multiple Pay Types: Supports salary, hourly, multiple pay rates, and contractor payments

Limitations:

Mobile Experience: No dedicated mobile app, though website is mobile-responsive

Integration Options: More limited third-party integrations compared to larger competitors

International Support: No international payroll capabilities

Reporting Depth: Basic reporting functionality may not satisfy complex analytical needs

OnPay is ideal for small to medium-sized businesses seeking straightforward payroll with included HR features, particularly those in specialized industries. Companies needing extensive customization or international capabilities should consider alternatives.

Overview of OnPay Features and Limitations

OnPay provides comprehensive payroll and HR services with a transparent, single-tier pricing model. The platform particularly excels in serving specialized industries like farms, restaurants, and nonprofits with specific compliance requirements and tax considerations.

Key Benefits:

Inclusive Pricing: All features available at one price point with no hidden fees or upsells

Industry Specialization: Built-in support for agricultural, nonprofit, and restaurant payroll taxes

Benefits Integration: Manages health insurance, 401(k), and workers' comp with automated deductions

Compliance Support: Handles tax filings across all 50 states with accuracy guarantee

Multiple Pay Types: Supports salary, hourly, multiple pay rates, and contractor payments

Limitations:

Mobile Experience: No dedicated mobile app, though website is mobile-responsive

Integration Options: More limited third-party integrations compared to larger competitors

International Support: No international payroll capabilities

Reporting Depth: Basic reporting functionality may not satisfy complex analytical needs

OnPay is ideal for small to medium-sized businesses seeking straightforward payroll with included HR features, particularly those in specialized industries. Companies needing extensive customization or international capabilities should consider alternatives.

Alternatives:

Load More

Load More

Load More

Newsletter

Be the first to discover new business tools and hidden gems. Join our insider newsletter 👇

Newsletter

Be the first to discover new business tools and hidden gems. Join our insider newsletter 👇

Newsletter

Be the first to discover new business tools and hidden gems. Join our insider newsletter 👇